How investing in creating a Golden record (single view) of customer helps banks and financial organisations to meet and accelerate APRA compliance and reporting.

When it comes to APRA compliance reporting, the main benefits of maintaining a golden record of customers are:

Accuracy: A golden record ensures that the information reported to APRA is accurate and up-to-date. This is important because APRA relies on accurate data to ensure the stability and soundness of the financial system.

Consistency: By consolidating information from different sources into a single record, a golden record ensures consistency in reporting. This reduces the risk of errors and inconsistencies that can arise when data is scattered across multiple systems.

Timeliness: A golden record ensures that the information reported to APRA is timely. This is important because APRA requires timely reporting of data to monitor the financial health of regulated entities.

Automation: Consistency of the golden record (format) allows for reporting to be automated, saving significant resource hours compared to manual data preparation approaches.

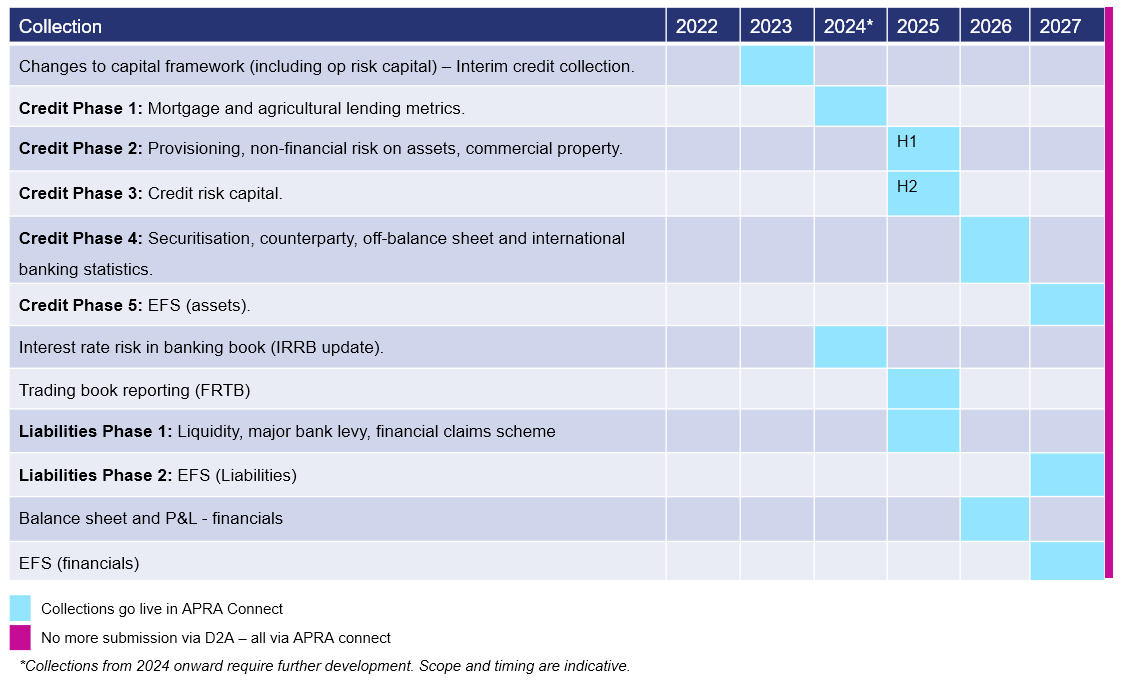

Future proofing: APRA have advertised their “Five Year Data Collection Roadmap” below, and having accurate, consistent and structured golden record data reduces future effort to meet their compliance requirements.

APRA 5 year Data Collection Roadmap

There are a number of steps you can take to streamline your APRA Connect reporting processes.

APRA Connect is the online portal regulated by the Australian Prudential Regulation Authority (APRA) allowing specified entities to submit various regulatory reports and notifications. The process of automating submissions through APRA Connect involves developing an application solution to automatically extract the required data from your internal systems and submit it to APRA Connect.

You can streamline your APRA Connect reporting processes and ensure that you are meeting your reporting obligations in a timely and accurate manner through adherence to the following steps:

Understand the APRA reporting requirements: Ensure that you have a thorough understanding of the APRA reporting requirements and deadlines for your organisation. This will help you identify the data you need to collect and report, as well as the deadlines you need to meet.

Standardise your data: Standardise your data collection processes and ensure that data is entered consistently and accurately across all systems. This will help to reduce errors and inconsistencies in your data, which can lead to delays in reporting.

Automate data collection and reporting: Implementing an automated system for data collection and reporting can help streamline the APRA Connect reporting process. This can include using software that integrates with your existing systems and automates data collection and reporting processes.

Assign responsibilities: Ensure that each person involved in the APRA Connect reporting process understands their responsibilities and deadlines. This will help to ensure that data is collected and reported in a timely manner.

Perform regular checks: Regularly check your data and reporting processes to identify errors or inconsistencies. This can help you to address issues such as non-compliance before they become larger problems that delay reporting.

Seek expert advice: Consider seeking expert advice from a consultant or advisor with experience in APRA reporting. They can help you identify opportunities such as the creation of golden customer records (single view of) to streamline your reporting processes and ensure that you are meeting all APRA reporting requirements.

Beyond accelerating APRA compliance and reporting, a single view of the customer, or a golden record, can be a powerful tool for creating new digital products and improving customer experiences.

By providing a comprehensive and accurate view of each customer, a golden record can help you better understand their needs and preferences, and tailor your products and services accordingly.

Achieving a golden record can also help you create new digital products and better customer experiences through:

Personalisation: A golden record allows you to personalize your products and services based on each customer's unique needs and preferences. This can help you create products and experiences that are more relevant and engaging for your customers.

Cross-selling and upselling: A golden record can help you identify opportunities for cross-selling and upselling by providing a complete view of each customer’s relationship with your organisation. This can help you create targeted offers and recommendations that are more likely to be accepted by the customer.

Improved service delivery: With a golden record, you can better understand each customer’s past interactions with your organisation, including any issues or complaints they may have had. This can help you identify areas for improvement and provide more responsive and effective service in the future.

Streamlined processes: By consolidating customer data from multiple sources into a single record, a golden record can help you streamline your internal processes and reduce duplication of effort. This can free up resources to focus on developing new digital products and improving customer experiences.

Investing in the creation of golden customer records can help banking and finance organisations ensure they are both meeting their APRA compliance reporting obligations by providing accurate, consistent, and timely data to APRA, as well as allowing them to transform faster and easier.

If you would like to know more on how 4impact can help you to streamline and accelerate your APRA compliance and reporting needs, as well as help you release your inner digital bank - visit our 4i Expert Banking web page here

David Freeman, Principal Consultant Banking

David Freeman, Principal Consultant BankingExtensive experience in designing and implementing complex banking applications. Skilled in system integrations, event-driven architecture, digitalization, and M&A banking technology consulting. Proven track record in driving operational efficiency, managing product roadmaps, and leading digital transformation initiatives for over 30 financial institutions. Strong leadership and consulting abilities in fast-paced environments, with expertise in Agile development, system integration, and industry compliance.